Enter your own figures in the calculator to find out how much compound interest you could make on your money.

Wondering how your savings account works? The power of compound interest means you earn interest on interest. Use the compound interest calculator to see the effects of compounding and interest rates on a savings plan. Adjust the lump sum payment, regular contribution figures, term and annual interest rate.

This is a compound interest calculator savers can use to get an idea of how returns and compound interest can work in their favour over the long term. It illustrates the effects of continuous compounding and the power of regular monthly savings over time. Fund charges or inflation have not been taken into account for this calculator.

Please also take a look at our other helpful savings calculators such as the Junior ISA Calculator.

What Does Compound Interest Mean?

How to explain compound interest?

Albert Einstein’s compounding interest definition was ‘The Eighth Wonder of the World’.

Compound interest is different to simple interest in that you the saver will earn interest on interest. For example, if you were to invest £5,000, at an annual simple interest rate of 5%, you would earn £250 each year. After 10 years, you would have amassed a total of £2,500 in interest payments. Not bad.

However, with compounding on your side, you would still earn £250 in year one, but this would be added to your total at the start of year 2. This would continue each year for the 10 years.

After 10 years of continuous compound interest at 5%, the tally would equal £8,235. That’s an increase of £735 on the rate offered by simple interest.

Try the cumulative interest calculator above to check your interest earned figure with a lump sum, a continuous contribution or both.

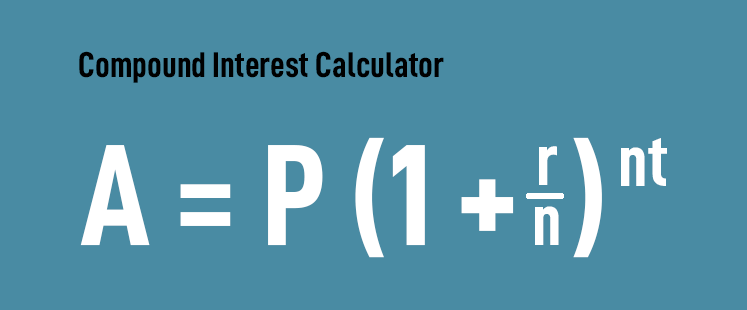

Compound Interest Formula

- A = Amount

- P = Principal

- r = Interest Rate

- n = Times interest is compounded per year (t)

- t = Time in Years

FAQ

Can Compound Interest Be Bad?

Compound interest is bad if it is working against you. For example, if you have a credit card and you fail to pay off the full amount every month. In this case, your interest would be accruing interest. Credit card debt can be particularly bad as the APR (Annual Percentage Rate) for many credit cards is around 20%. Consider that a good rate for a savings account these days is in the region of 0.5% and you will understand just how bad compounding can be in relation to the debt that can be accrued on credit cards.

How Can Compounding Make my Savings Grow?

If you want to see your savings grow then compound interest can be your best friend. Compounding means earning interest on top of interest. This also means that the longer you leave your money in your account, the more you can benefit from the effects of compounding. Of course, the higher the rate of interest or rate of return on your savings account will also make a huge difference to your bottom line.

How Can You Calculate Compound Interest Easily?

Calculate compound interest by using the interest calculator on this page. Use the sliders to adjust your lump sum amount, the number of years you will be saving or investing, your regular contributions and your interest rate.

Awesome calcultor! – People need to understnad the value of compounding! People with kids should start their kids off in a 7% growth product and then have them take it over after educating them when they are 18. They will have a millon pound fund by the time they retire at 65, and if you start that when they are very young, say 5 years old that will only be a small amount each month….

Thanks John. Yeah I guess the secret is to have compounding working for you rather than against you!!

Great calculator and simple explanation of the subject. A friend of mine put me onto compound interest and it’s opened my eyes to a new, and better, way of saving.

Do you recommend any compound interest accounts?????